Why Aussie's Choose Jade

Cheap equipment loan interest rates

Using Jade is the right decision

A company that delivers

Empowering Perth Businesses with Customised Equipment Finance Solutions

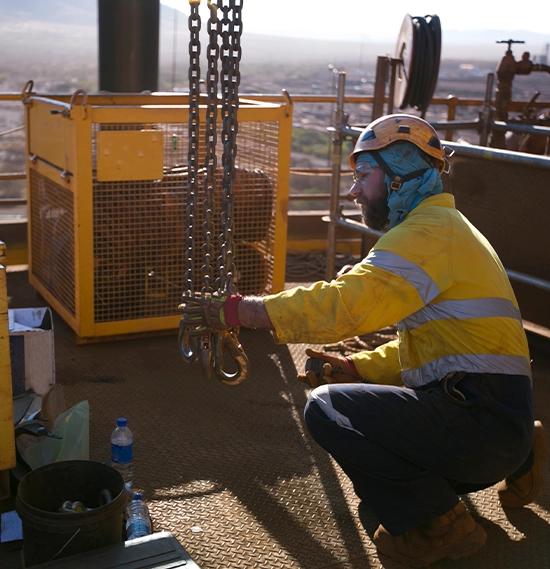

In fact, as specialist heavy machinery finance loan providers, many of our clients are major players in the resources and mining sector with sites in some of the most remote areas of WA. As specialists, we identify the distinct requirements of these WA customers and ensure our services meet their needs.

If you operate a Perth-based business, you are assured of getting the same superior Jade service for your business loan needs as any other business in Australia. We offer lending to suit all types of business from our range of products including Chattel Mortgage, Equipment Lease, Equipment Rental and CHP.

Flexible Solutions for Equipment Purchases, Refinancing, and More

Our services include finance and loans on new and used equipment purchased through an authorised manufacturer’s dealer, at auction or through a private seller. Purchases from any location in Australia or overseas. Your Jade Equipment Finance consultant will structure your finance deal to suit and provide a fast approvals process if you need to move fast.

If you are currently mid-way through a finance deal you arranged on equipment through another source and perhaps the terms of the loan or repayments are no longer working for your business, then talk to us about our refinancing options. Your Jade consultant can discuss the options and if you are also seeking a quote on a new purchase, there is the possibility of rolling both loans into one repayment.

Our service extends to bad credit equipment loans, debtor finance, business overdrafts and insurance premium finance. So we have a finance facility for the full spectrum of equipment and the broad range of business operating requirements.

Loans Calculator

The use of this calculator is predicated on the user’s understanding and also consent that the estimated figure presented does not specify a loan quote; it does not indicate an application for any loans has actually been lodged; it is not an implication that any type of loan application has actually been approved. The format of this tool does not consider specific information concerning any type of particular individual financing application or any loan provider fees as well as costs. It is formatted to supply a general result based on general information and also values solely.

After lodging a formal loans application, the quote and also repayment amounts that you may possibly be given may differ from the finance quote accounted by this tool.

The device is not ideal for computations on finances that are established on a rate of interest just basis. The formatting is totally established to compound the calculated interest rate for a set period based upon the amounts typed in by the individual.

The calculator is not intended as a device for finance decision making. Individuals that call for financial advice need to choose an expert monetary advisor in regard to their circumstances. To make an application for lending and also receive a quote based upon your individual requirements, the user should speak to Jade and also have their personal application reviewed by one of our Jade professionals.

While some lenders may not want to venture across the Nullarbor from the comfy East Coast offices, we’re already handling equipment finance for our Perth customers.

If you’re based in Perth or any other part of WA and need machinery finance, please call Jade on 1300 000 003 for a great loan offer.

| Lender | Loan Product | Interest Rates From | Monthly Repayment |

| {{Lender}} | {{Loan Product}} | {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY |

|

{{Lender}}

{{Loan Product}}

|

||

| {{From - Advertised Rate}}{{Rate Type}} | ${{Payment Amount}} MONTHLY | |

THE INTEREST RATE IS CALCULATED ON A SECURED LOAN PREDOMINATELY FOR BUSINESS USE, EFFECTIVE 29/04/2025 AND SUBJECT TO CHANGE. WARNING: THE INTEREST RATE IS TRUE ONLY FOR THE EXAMPLES GIVEN AND MAY NOT INCLUDE ALL FEES AND CHARGES. DIFFERENT TERMS, FEES OR OTHER LOAN AMOUNTS MAY RESULT IN A DIFFERENT INTEREST RATE.

We work harder to secure the best rates.